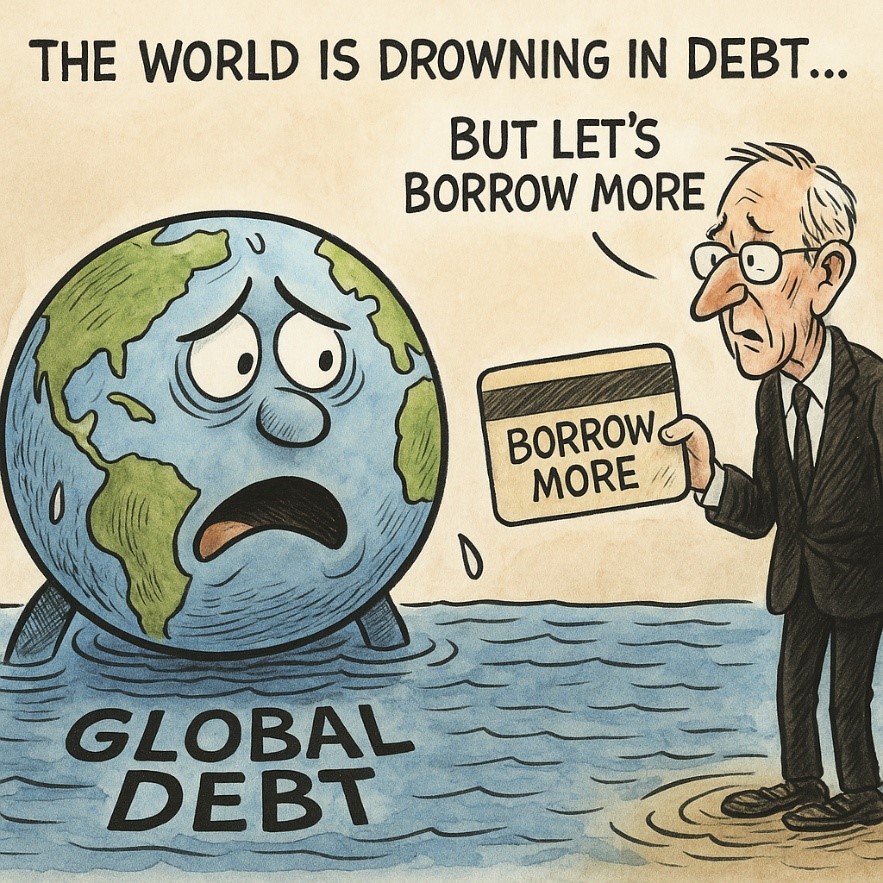

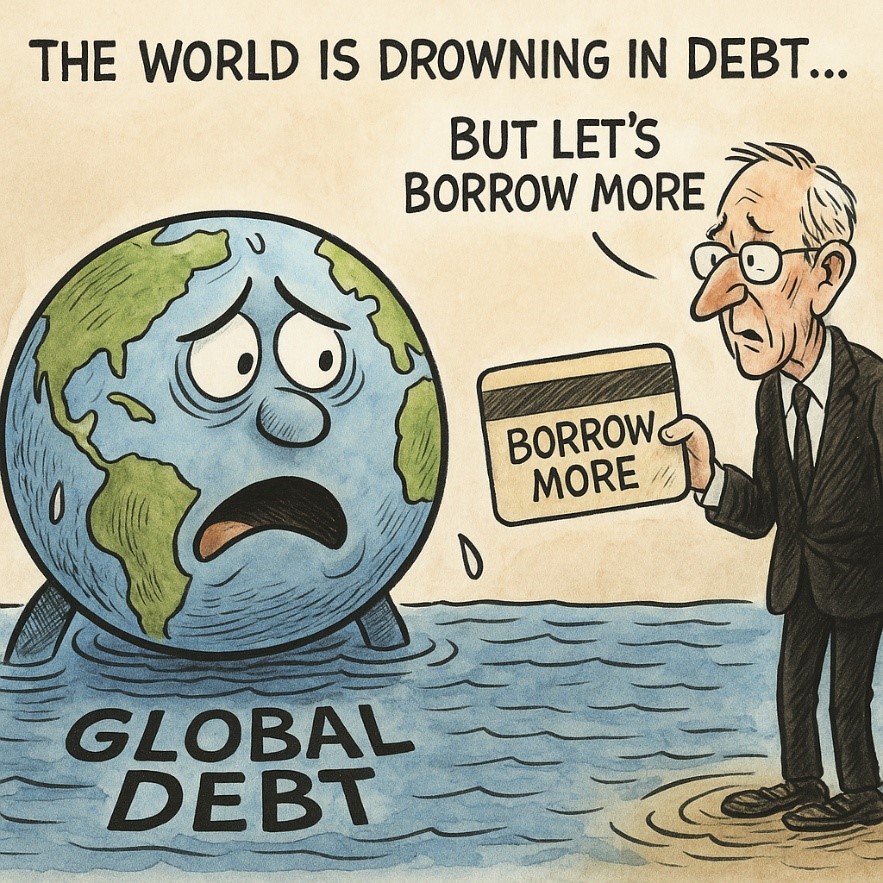

IMF warns: 55 countries are struggling with debt stress. The world nods, holds another conference, and goes back to swiping the global credit card.

So, fifty-five countries are gasping under debt. Their currencies wilt, their budgets crack, their ministers shuffle papers before boarding flights to Washington.

The question that should follow is simple: and the rest of the world — are they alright?

Haha. Not quite.

Neither the United States, nor Japan, nor Italy, nor France, nor the United Kingdom can claim to be debt-free saints. Each one carries a debt mountain taller than its Parliament dome — only difference, they have better lighting, larger microphones, and an audience that claps on cue.

The Privilege of Being Heard

When a poor nation stumbles, it’s called fiscal irresponsibility.

When a rich one does, it’s counter-cyclical policy.

That’s the real divide between the 55 debt-distressed and the so-called elite: who gets the benefit of narrative.

Remember Greece, circa 2010? When its numbers collapsed, European leaders flew in rescue missions and called it solidarity.

Contrast that with Sri Lanka, when its fuel ran out — there were no emergency summits, just emergency exits.

IMF runs to Greece; Sri Lankan leaders run for their lives. That’s economics with a passport.

A World on the Credit Card

From households to governments, we have perfected the art of living on tomorrow’s income.

Debt is now the most democratic of instruments — everyone qualifies.

Everywhere, it’s the same melody — borrow, promise, postpone. The debts our generation enjoys will be inherited by children who never voted for them.

The Politics of Perpetual Overdraft

The French minister who quit is not alone. He follows three others who tried tightening belts in a room full of voters wearing elastic trousers.

Britain has had four prime ministers in four years — each one vowing stability before discovering the Treasury overdraft.

In Washington, debt ceilings are raised with ritual drama; in Tokyo, deficits are rolled over like cherry blossoms — pretty while they last, forgotten when they fall.

It’s no longer fiscal policy; it’s a global instalment plan.

The Experts Will Explain (Eventually)

Not to worry, there’s always Wall Street, S&P, and a few Nobel laureates ready with a comforting model.

Someone in Stockholm will soon hand out another prize for a theory explaining how we should have behaved in 1973.

The media will hail it as timeless wisdom — and by evening, governments will approve fresh borrowing to fund “innovation” in deficit management.

The Truth Beneath the Humour

Behind the irony lies a stark question:

If the world’s top economies — those that set the rules, control credit ratings, and anchor currencies — are themselves drowning in IOUs, who exactly is safe?

When confidence slips and currencies slide, debt doesn’t just sink nations — it drags trading partners, investors, and ordinary citizens down the same whirlpool.

The last time that happened, in 2008, we called it a global financial crisis.

This time, it might simply be called normal..the new normal.