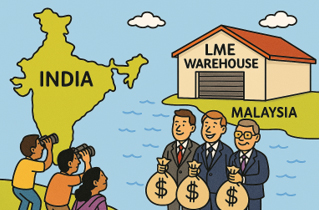

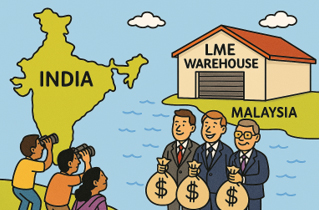

Do you know an aluminium ingot, fresh from a smelter in Odisha, can still take the long way home? Even if a factory in Pune or Chennai is waiting for it, the metal is first put on a ship to Johor in Malaysia.

Why? Because that’s where the nearest London Metal Exchange (LME)-accredited warehouse sits.

There, it waits. Rent meters ticking, someone in Singapore or London quietly counting the cash. Months later – after the ritual dance of paperwork, handling fees, and a touch of market theatre – the very same aluminium might find itself sailing back, this time with a price tag “discovered” thousands of miles away.

It’s a strange detour, but that’s how the LME’s global delivery system works. And it doesn’t just apply to aluminium. Copper, zinc, lead, nickel – every non-ferrous metal traded on the LME follows the same rule: if you want to settle a contract physically, delivery has to be to an LME-accredited warehouse.

Why does this happen? Because big buyers and sellers – banks, funds, and trading houses – want prices to be discovered in a transparent, standardised, and globally accepted system. The London Metal Exchange provides that platform, but it only recognises delivery through its own accredited warehouses. Since India doesn’t yet have an LME-accredited facility for physical settlement, trades involving Indian metal must pass through the nearest one – in Johor, Malaysia – even if the final buyer is back in India.

The Eastward Shift No One Bothered to Follow

In the last two decades, Asia has become the biggest metals dining table in the world – and India is a large, hungry guest. We consume over 4 million tonnes of aluminium, 1.1 million tonnes of refined copper, and nearly 0.8 million tonnes of zinc annually, spread across power cables, transport, construction, electronics, and packaging.

Yet none of these metals can be delivered into an LME contract within India. The exchange’s warehouse map is still dominated by old trade centres – Antwerp, Rotterdam, Detroit – with a handful of Asian pins in Singapore, Johor, and Busan. India is nowhere.

The Aluminium Triangle – and Its Non-Ferrous Cousins

Think of three Indian players:

Whether it’s aluminium, copper, zinc, or nickel – the cost, the delay, and the loss of control are the same.

Canada’s Lesson – Closer is Smarter

It’s not just Asia facing this. Canadian producers, once content to store and trade via US-based accredited warehouses, are now bypassing America and looking for hubs nearer to end markets. The reason? Tariffs, border delays, and the cost of long detours. In metals, like in food, it pays to be near the plate, not the pantry.

For India, the logic is even stronger. We are the plate – a massive consumption point in the fastest-growing region. The warehouse should be here, not three thousand nautical miles away.

It’s Not Just Metals

Commodity-exchange-linked warehouses aren’t only for metal. If it’s quoted and contracted through a commodity platform, it can sit in one:

India is already a top importer of vegetable oil (over 16 million tonnes a year) and pulses (around 2.5–3 million tonnes annually). These are structural imports – land, water, and WTO rules mean they won’t fade.

An international commodity exchange–accredited warehouse in India would let imported goods be delivered, stored, and traded right here at global benchmark prices—without first going to a foreign delivery point. For exporters, it means they can “deliver” into a global contract from an Indian port, making Kandla, Mundra, or Chennai recognised delivery hubs for buyers worldwide. This cuts double-handling, shipping detours, and storage costs, while attracting global traders to route contracts through India. The result: faster turnover for Indian importers, better liquidity for exporters, and a stronger role for India in global price discovery.

Who Owns the Keys, and Why They Don’t Move Them

The LME itself doesn’t own warehouses. Licences go to logistics and trading giants like Glencore’s Pacorini, ISTIM (UK), C. Steinweg, Henry Bath, Metro International.

Their model is simple:

After 2008, some warehouses became rent factories, keeping delivery queues long and margins fat. Moving to India means new investment, regulatory changes, and giving up existing cash flows in Antwerp or Johor – so they don’t rush.

Media Calls Out the Absurdity

It’s not just traders and producers who find the Johor detour baffling. International outlets like S&P Global Commodity Insights, AL Circle, and Discovery Alert have all reported how Indian aluminium, despite being produced and often consumed in India, ends up filling LME-accredited sheds in Malaysia and Singapore. AL Circle even quoted an industry voice asking, “Why does India need to ship out 1.5 million tonnes of aluminium to Southeast Asia? Are we not burning fuel?”

The inefficiency is plain enough to make foreign media shake their heads. Yet, curiously, no major Indian outlet has dwelt on this round-tripping. Whether through oversight or disinterest, the silence is telling.

📦 Fact Sheet – Who’s Talking About India’s Aluminium Detour

Signs of Change – Elsewhere

In 2025, LME approved Hong Kong as a delivery point – a smart bridge into China without mainland entanglements. Saudi Arabia’s Jeddah got the nod for copper and zinc. Canada is exploring more local delivery points.

These moves show that exchanges adapt when consumption shifts. India’s scale, growth, and location give it a stronger case than most.

What India Stands to Gain

If India hosted LME-accredited warehouses:

It’s a shift from price-taker to price-maker.

How to Bring the Exchange Home

It will take:

The Shortest Route is the Smartest

Right now, an aluminium ingot from Odisha – or copper cathodes from Gujarat, or sunflower oil from Kandla – might travel more than a cruise liner before reaching its final Indian buyer. That’s wasted time, wasted money, and wasted opportunity.

In global trade, efficiency is profit — and profit is power. Bring the warehouse here, and the journey is short, the profits stay home, and India steps into its rightful role as Asia’s next commodity hub.

After all, why send our goods on a long, costly holiday just to buy them back?