“Success breeds complacency. Complacency breeds failure.” — Andy Grove

By Ravishankar Kalyanasundaram

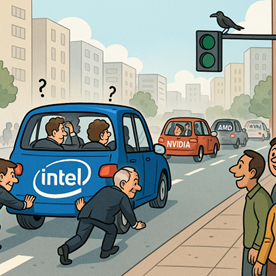

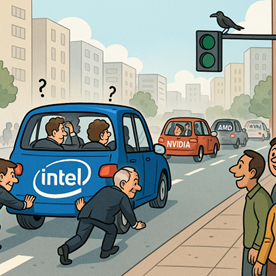

A Rescue at the Crossroads

The American Government’s recent multibillion-dollar rescue of Intel is more than industrial policy. It is a headline about history repeating itself — Silicon Valley’s one-time emperor, the company that made the world chant “Intel Inside,” now stalled at the traffic lights while Nvidia, AMD, TSMC, and Qualcomm speed past.

The bailout underscores a blunt truth: even the strongest car can stall when it forgets to look after its engine.

From IBM’s Grip to Intel’s Glory

Intel’s rise began in the 1980s, when IBM — fearful of cannibalising its lucrative mainframe business — hesitated to adopt chips that might render its stock obsolete. Andy Grove, Intel’s paranoid visionary, saw the gap. His mantra, “Only the paranoid survive,” became corporate scripture.

But Grove’s real genius was not only in silicon but in marketing. In 1991, Intel launched the Intel Inside campaign, funding PC makers’ advertising in return for putting its logo on every machine. Suddenly consumers no longer asked for IBM or Compaq — they demanded Intel.

That sticker turned a hidden component into the world’s most famous brand. Intel Inside was such a headline-grabber that it became a Harvard Business School case study, featured in management books, and taught worldwide as the textbook example of how a supplier could leapfrog into consumer consciousness. For two decades, Intel seemed untouchable.

The Rear-View Mirror That Wasn’t

Yet markets never run in a straight line. While Intel sprinted ahead in CPUs, it ignored the bend where GPUs emerged. Nvidia, once a scrappy graphics company, recognised that its chips could power artificial intelligence, data centres, and machine learning. By the 2010s, Nvidia had eclipsed Intel in market value and relevance.

AMD fought its way back with Ryzen and EPYC. TSMC and Samsung became the masters of advanced chipmaking while Intel stumbled in its fabs. Qualcomm dominated mobile — a space Intel barely entered.

The emperor was still in the race, but the crowd was waving goodbye.

The Gallery of the Fallen

Intel’s fate is not unique. Business history is littered with giants that mistook pipelines for purpose:

The irony is cruel: their downfall came not from ignorance, but from knowing too much about their current success.

Billions for Nostalgia?

Washington’s rescue billions are pragmatic: semiconductors are the new oil, and dependency on Taiwan or Korea is risky. Intel is being cast as America’s champion.

Yet the risk is plain: without reinvention, lifelines become subsidies to nostalgia. Bailouts don’t build relevance. They only buy time — if the company dares to disrupt itself.

The Indian Parallel

For India, this parable offers a mirror.

We take pride in our IT services, start-ups, and digital platforms, and rightly so. But it may also be worth reflecting on how easily success can create comfort. There are moments when industries lobby for protection rather than transformation. One recalls the way EV adoption was initially slow to gather pace, or how spectrum auctions in telecom often became battles of survival rather than a platform for innovation. In energy, too, incumbents sometimes advance at a cautious pace even as the world accelerates toward renewables.

These are not failures, but reminders that progress requires more than announcements. It requires a willingness to embrace disruption — sometimes even at the cost of today’s advantages.

Progress Reports, Not Promises

We often say policies are announced, allocations made, and targets set — but announcements alone cannot build an economy. Execution requires not only monitoring but professional guidance. Even something as routine as clearing old files in ministries needed the Prime Minister’s personal intervention. That speaks to the deeper challenge: India’s industries require not just support, but structured leadership.

What we need is a high-powered national team — drawing on leaders like Nandan Nilekani, industry captains, and experienced technologists — to guide joint ventures, bring in technology partners, and ensure our industries are not just protected, but kept globally relevant.

This becomes critical in areas where the race is already underway:

This is not about patronage or subsidies. It is about building an ecosystem where industry and government work together with clarity of purpose. Policies must back innovation, help Indian firms absorb global know-how, and prepare them for obsolescence cycles that come faster each year.

The lesson from Intel is sharp: a great brand, once world-dominating, can lose its crown if it is not paranoid about relevance. India cannot afford to be another Intel — proud of yesterday’s successes but stranded tomorrow at the green light while the race moves on.

Final Reflection

Intel’s story is not just about a fallen emperor; it is about the risk of confusing yesterday’s crown with tomorrow’s survival.

For India, the lesson is worth keeping in view:

Because the real question is not whether you were once ahead, but whether you remain relevant in the race. The global economy is not a parade of companies; it is a relentless race where position matters. In today’s tariff-driven world, we need to be in that race — not even to win, but simply to survive.

Policies must be forward-looking, rooted in adaptation to new technologies, and alert to obsolescence. Comfort today can be a trap tomorrow. Just as Intel missed the curve of GPUs, nations that ignore technological shifts risk being stranded at the green light while others speed past.

The irony is sharp: the marketing campaign that once became a Harvard case study now sits as a cautionary tale in business history — proof that relevance, not reputation, is the only true currency in the race.